Online sales reached $33.9B over Cyber Week 2021, down 1.4% from 2020 and a clear reflection of the extended shopping season this year. The new shopping season started as early as September with deals and a wide-spread awareness of supply-chain issues, shipping delays, and inventory availability.

As 2021 presented its own set of unique challenges, retailers have risen up to them, looking to mitigate the impact on consumers both financially and logistically while “consumers respond[ed] to this holiday season’s challenges with flexibility.”

Let’s see how Justuno customers fared over BFCM 2021 and what onsite messaging had the best performance this year.

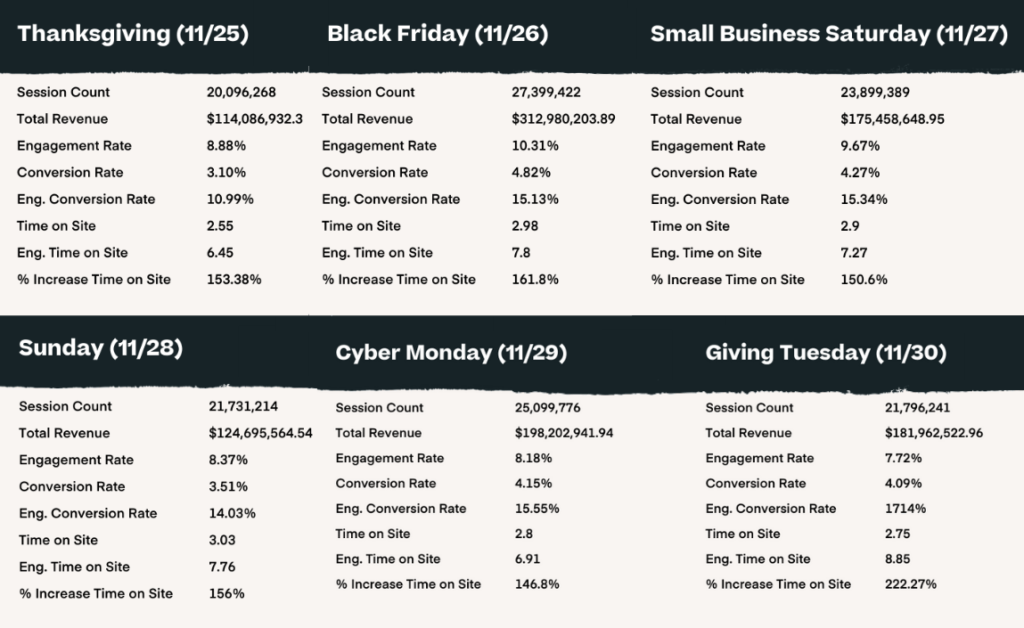

The 5 Days of Cyber Weekend

On the first day of cyber weekend my true love bought for me…

While cyber weekend doesn’t rhyme quite as nicely as “Christmas,” its first day was certainly full of shopping. Thanksgiving is the smallest of the days but still popular for some consumers. With 20 million sessions recorded this year (down from 20.6 in 2020), the impact of many big-box retailers remaining closed for the second year in a row doesn’t seem to have had as big of an impact this year. However, revenue reached $114 million for Justuno retailers with a strong conversion rate of 3.1% that jumped to 10.99% when engaged by a Justuno promotion.

Black Friday was the winner again for the second year in a row (surprise surprise!) for total revenue, highest conversion rates, and time on site. Justuno customers’ average conversion rates came in at a healthy 4.82%, bringing in $312.98 million in revenue and jumping up to a 15.13% conversion rate when engaged by a promotion. This blew the rest of the weekend out of the water both in terms of total sales and overall website traffic with Justuno customers making an average of $11.42 on every visitor session and $237.05 per order.

Twenty-four percent of US consumers said they were planning to shop on Small Business Saturday to support local businesses and those conscious shopping decisions were reflected in the 4.8% conversion rate that came in second only to Black Friday. 23.8+ million sessions were recorded that day which was the highest of all three non-BFCM days over the weekend.

Cyber Monday, the namesake of the week, is one of the most popular days of cyber weekend, where typically the most money is spent. According to Adobe Analytics, consumers spent a total of $10.7B this year – down only $100M from 2020. For Justuno customers, Cyber Monday was the second biggest day behind Black Friday coming in at $198.2M with 7.5% of that from pop-ups featuring a 15.55% conversion rate.

Finally, to close out the weekend is Giving Tuesday, a day that has come more into the spotlight as consumers demand accountability and transparency from the brand they support. With total sales in third place for the weekend coming in at $181.9M for Justuno users, an overall conversion rate of 4% that jumped to 17.14% when engaged by a pop-up, it’s clear this is a day that resonated with shoppers. Giving Tuesday also holds the winning spot for the longest increase in time on site with pop-ups: increasing a visitor’s time on site by 222%, versus 146.8% on Cyber Monday and 161.8% on Black Friday!

During Cyber Weekend* over $1.107 billion was earned by Justuno customers with 7.41% of that driven by Justuno pop-ups, and representing 3.2% of all Cyber weekend spend. That is a 22.98% increase in overall Justuno customer revenue from BFCM 2020 at $900.5 million.

Justuno customers had an average engaged order value of $140.82, increased time on site by 164% with promotions boosting average time from 2.8 to 7.5 minutes, and overall converting visitors 265% more with engaged conversion rates averaging 14.76% all weekend compared to 4% overall.

*Cyber weekend is Thanksgiving 11/25 to Giving Tuesday 11/30

Pop-Up Performance: A Look at Top-Converting Styles

We’re always being asked what best practices are for pop-ups during cyber weekend: what’s the best converting style, what not to do, how big they should be, etc. While every website is different, there are a few general tips for success.

During Cyber Weekend:

- Avoid lead capture and multi-step promotions

- Keep it as simple as possible for your visitors

- Make it worth their while if you are going to interrupt them

Let’s check out what Justuno users did for their what and where of onsite messaging strategies.

Location, Layers, and Plug-ins

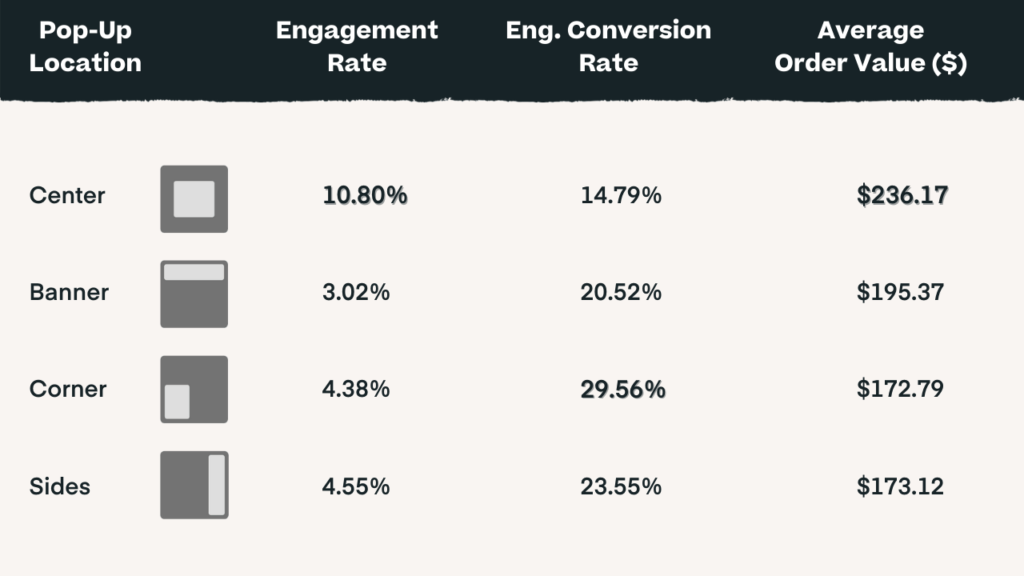

When you think of pop-ups, you probably think of center promotions; The eye-catching messages that display front and center, directly in front of visitors. As the most used placement by far, center pop-ups had the highest AOV at $236.17 and the highest engagement rate at 10.8%. But when it came to conversion rates, they actually came in last place at 14.79% (though still a significant conversion rate). This is due to a variety of factors, most importantly that the last promotion interacted with is attributed with the conversion. So, those with in-cart promotions will see lower conversion attributions when it comes to the promotions shown when someone first comes to your site. Think of center promotions as high-value assists for your onsite conversion strategy.

Banners are a tried and true CRO staple during the holidays with their mobile-friendly design and non-interruptive nature. We encourage customers to use banners for site-wide messaging, shipping info, important deadlines, customer support, etc. They were the second most popular location for pop-ups and boasted the second-highest AOV at $195.37 while the overall engagement rate was low (3.02%). The low engagement rate is due to their information-focused use versus other popular promotions, which are engagement-focused with engaged conversion rates at a high 20.52%.

Corner and side pop-ups are a rising trend we’re seeing for more creative pop-up designs and placements, repeating their first and second place wins from last year. Corner promotions had the highest conversion rate of the weekend at 29.56% despite being the least popular placement and 23.55% conversion for side promotions. Their high AOV of $172.7 in the corners and $173.1 on the side prove these are still winning promotions for marketers to use when looking to create subtle yet noticeable pop-ups, or appeal to a more mobile-forward audience.

Now that we know where retailers were using pop-ups during BFCM, let’s dive into the what and how of their onsite messaging campaigns. With Justuno, these two plug-in layers can be added to a promotion to drive sales even higher:

*Commerce AI is Justuno’s intelligent product recommendation engine

The takeaways from these stats are:

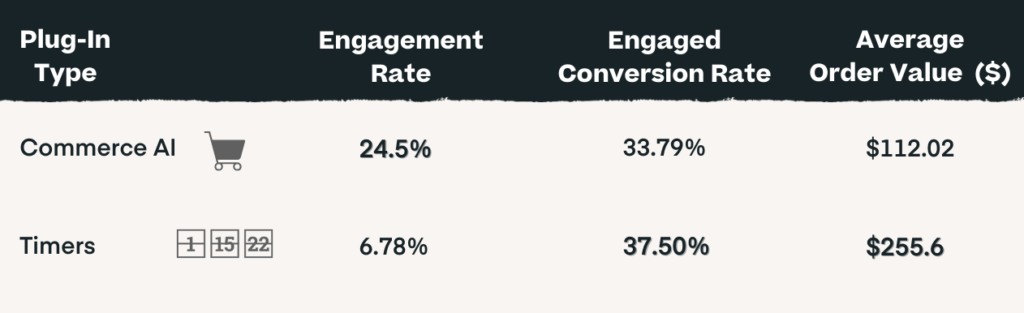

- Timers are an incredibly important addition to drive consumer urgency and boast the highest AOV of any layer option. Within the scope of BFCM being a limited-time event driven primarily by the fear of missing out on a great deal and limited available inventory – their impact is clear.

- Justuno’s intelligent product recommendation engine, Commerce AI, was the leader in engagement and boasted a 33.7% conversion rate. While BFCM is usually discount-focused, personalization was a clear draw for shoppers to engage with. With Justuno, engagements are registered as either a call to action (CTA) click (on the recommendation itself) or being on screen for > 7 seconds making it a clear winner for making an impact over the weekend.

Coupons are a defining feature of BFCM, but surprisingly this year’s engagement rates for promotions with vs. without them had a very close 8.6% vs 8.3%, respectively. When it came to converting engaged traffic, coupons won out with 20.83% vs 15.5%. This could be due to a variety of factors like merchants choosing to use manual coupons rather than auto-apply in their promotions or as many predicted the supply chain issues meant smaller inventories that didn’t necessitate the deep discounting of previous years. Less inventory equals less to sell and no need to discount the leftovers!

Mobile vs. Desktop

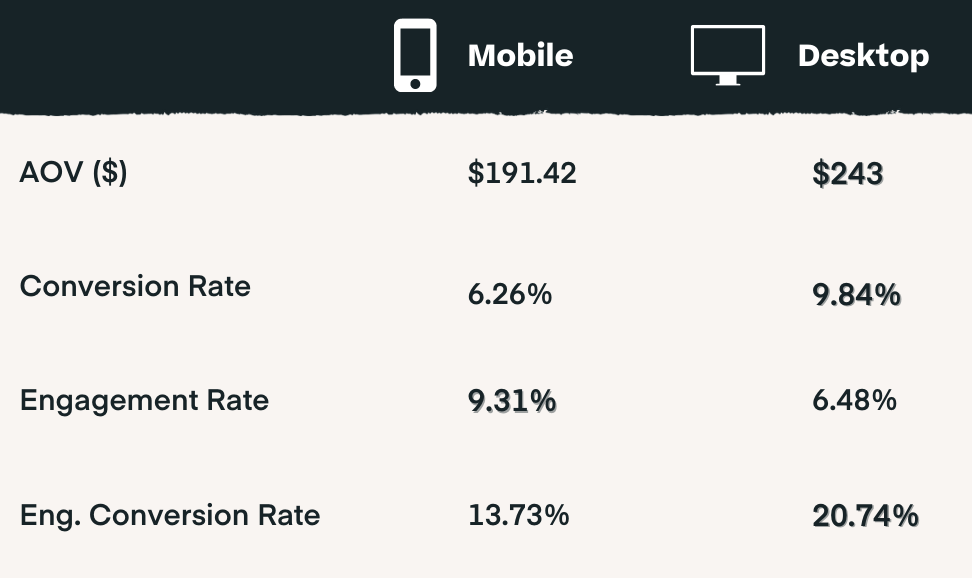

Despite shoppers claiming to shop using their mobile devices (75% saying they would be shopping on mobile this year), desktop continues to reign supreme. Conversion rates were higher for desktop users at 9.84% and 6.26% for mobile, but mobile visitors were more engaged with promotions at 9.31% vs. desktop’s at 8.48%. The impact of engagement to conversion rate skyrocketed desktop conversion rates to 20.74% vs. mobile’s 13.73%. Importantly, desktop’s average order value was also much higher at $243 to mobile’s $191.42. – more than a $50 AOV difference and worth keeping in mind for future holidays.

Mobile visitors are plentiful and ready to engage/opt into promotions, but not necessarily at the point of conversion. It supports the theory that mobile is still primarily a discovery and research channel while desktop holds strong as the final point of sale. This could be due to a variety of reasons like poor mobile experiences, difficulty checking out (unoptimized mobile carts), or slower website speeds. Take this as an area of opportunity for next year to stand out from the crowd and capture the attention of mobile shoppers to convert them earlier in the sales journey via an optimized mobile experience that streamlines any barriers to conversions you may have.

Industry Leaders

Breaking down BFCM by industries reveals a lot about consumer behavior and gifting trends in the long run. According to Justuno’s survey of 300+ US consumers*, they were planning to gift these categories:

-Clothing 52%

-Games/Toys: 46%

-Cosmetics: 19.2%

-Beverage & Foods: 20.4%

-Jewelry: 25%

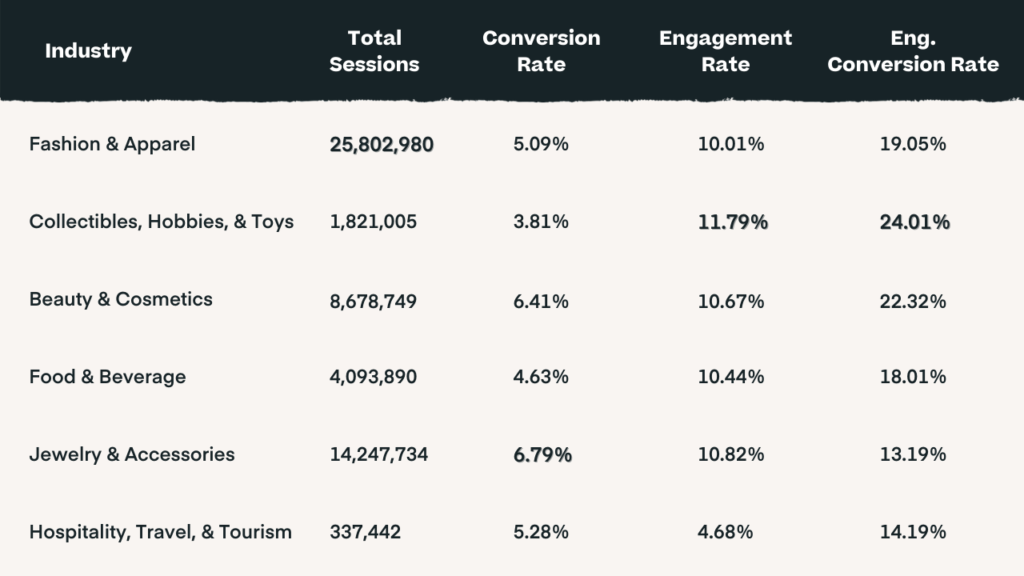

When compared to actual BFCM performance, there were a few surprising contenders when broken down by website traffic, conversion rate, and engaged conversion rate.

The major industries that people were planning to shop all had solid traffic levels and overall engagement/conversion metrics. One surprise was the hospitality, travel, and tourism industry who, while having low overall traffic levels, had an exceptionally high conversion and engaged conversion rates demonstrating a smaller but high intent audience. Considering the impact that the pandemic has had on this industry, it’s not surprising that consumers are looking to plan future trips and spend their holiday money on experiences they’ve been unable to otherwise in 2021.

*A survey conducted by Justuno this summer of 330 U.S. consumers

Final Thoughts

BFCM 2021 was an interesting one. There was more emphasis on certain promotion styles than in previous years. We’re seeing retailers break out of the mold when it comes to where they place promotions and where consumers are shifting their focus (and dollars) when it comes to holiday shopping.

For the first time ever, online spending during BFCM didn’t break sales records and actually decreased slightly YoY compared to 2020. But the 2021 holiday season was also the longest yet, with consumers not waiting to see what deals may come later in the season due to fears of supply chain strains, stock-outs, and delayed deliveries. In fact, online spending for the entire season totals $109.8 billion which is up 11.9% from 2020.

E-commerce is not slowing down, but becoming a daily occurrence rather than an occasional shopping destination. Our world has been turned upside down as retailers and consumers alike the past two holiday seasons but we’ve seen Justuno customers adapt to shoppers’ needs in a remarkable way.

Perhaps BFCM will come to be seen not as the super bowl of e-commerce, but give way to an extended holiday shopping season that enables consumers to shop when, where, and how they want.