As we kick off Q3, marketers across the world are beginning to finalize their plans for the Q4 holiday season. Justuno’s consumer trends report aims to empower marketers with actionable insights for an improved online experience for shoppers.

This report surveyed the preferences and experiences of respondents’ 2023 holiday shopping, with over 260 respondents in the United States.

The experiences of consumers last year can help serve as a guiding light for brands looking to refine their strategy for the 2023 holiday season: providing insight into consumer behavior and what it is, they’re looking for from brands this year.

Top Findings

While we break down each question individually below, take a look at the most immediately surprising results:

Bullish On Spending. The spending outlook is robust for 2023 despite record inflation and continued economic uncertainty worldwide. On average, 46.18% of consumers plan to spend the same as in 2022, 17.18% are planning to spend more, and 10.69% don’t budget or plan their spending at all.

Activism Takes a Backseat. Social causes don’t seem to matter to consumers, at least when it comes to holiday shopping. 81.6% of consumers say a brand’s social causes aren’t a consideration for them this year.

In-Person Shopping Is Back. After a few years of stores being put on the back burner for a reason, they’re back with a vengeance. Over a third of consumers plan to do the majority of their shopping in person, and that’s where nearly a quarter of them get the majority of their gift ideas.

Email Is Still The Champ. Consumer preferences for where to hear from brands remained largely unchanged from 2022 to 2023. Email is the most preferred by a mile, with SMS still not even breaking 10% of consumers’ preferences.

Consumer Survey Questions

Our survey consisted of 14 questions with 263 US consumers of randomized location, income, gender, and age. Let’s see the behavioral trends they revealed:

When do you plan on starting your holiday shopping?

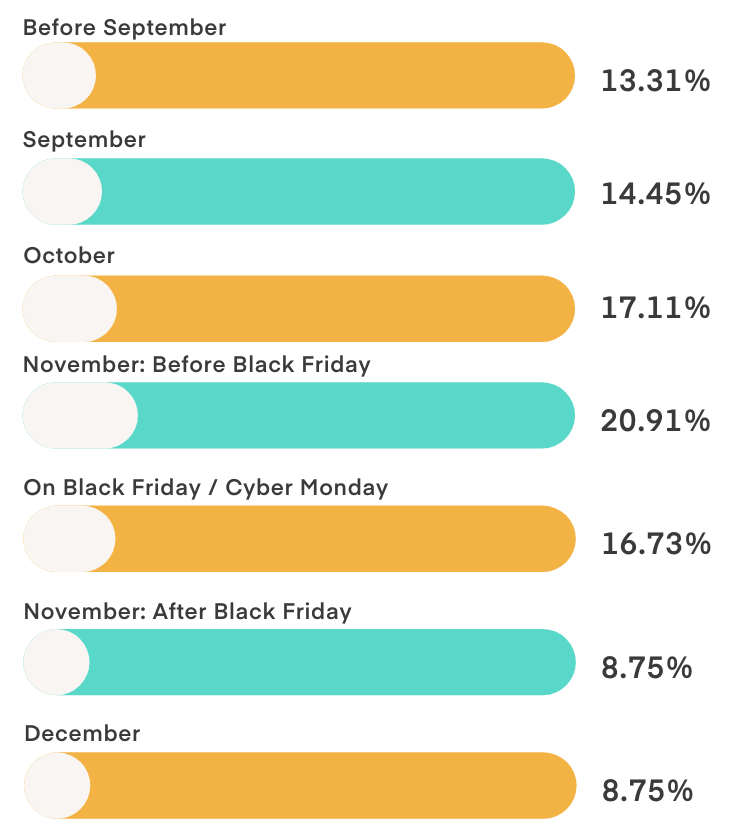

More than a quarter of US consumers are planning to start shopping before October—which means that you need to get started right now. The longer sales season is here to stay – before November arrives, 44.87% of consumers will have already started shopping. If you’re waiting for BFCM, it’s too late.

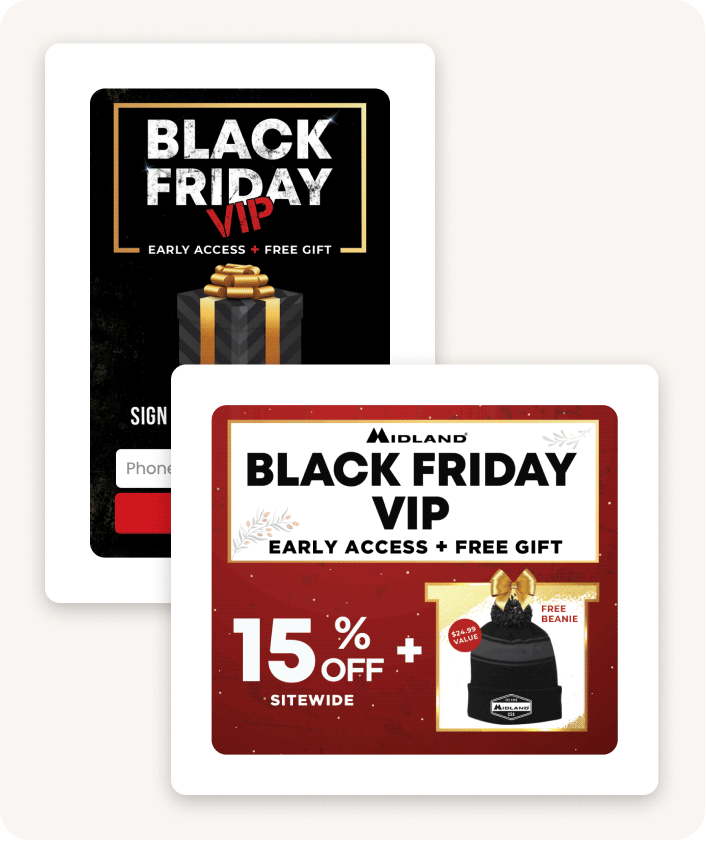

Get started early and keep momentum throughout the entire quarter. If you choose to wait until BFCM to start your holiday sales, build buzz and advertise its upcoming debut through VIP access sign-ups, a countdown, etc. Make sure customers know about it so they can choose to wait if they want; otherwise, they may simply go elsewhere without knowing any better.

Only 16.73% of shoppers plan to wait until BFCM weekend to start shopping—and even for this segment, you want to make sure you’re on their radar for the brand to shop when the big day finally arrives.

Justuno customer, Midland, advertised VIP/early access to their Black Friday sale for SMS subscribers; this incentive drove a 210% growth in their database.

Another thing to consider when planning for a varied shopping schedule is the concern over price adjustments and holding out for the best—when it’s your best discount of the season, say that. Or ease their minds by saying you’ll honor a price adjustment within a specific timeline if it goes on sale—not only will that build trust, but also removes conversion hesitations by knowing they’re not going to be missing out.

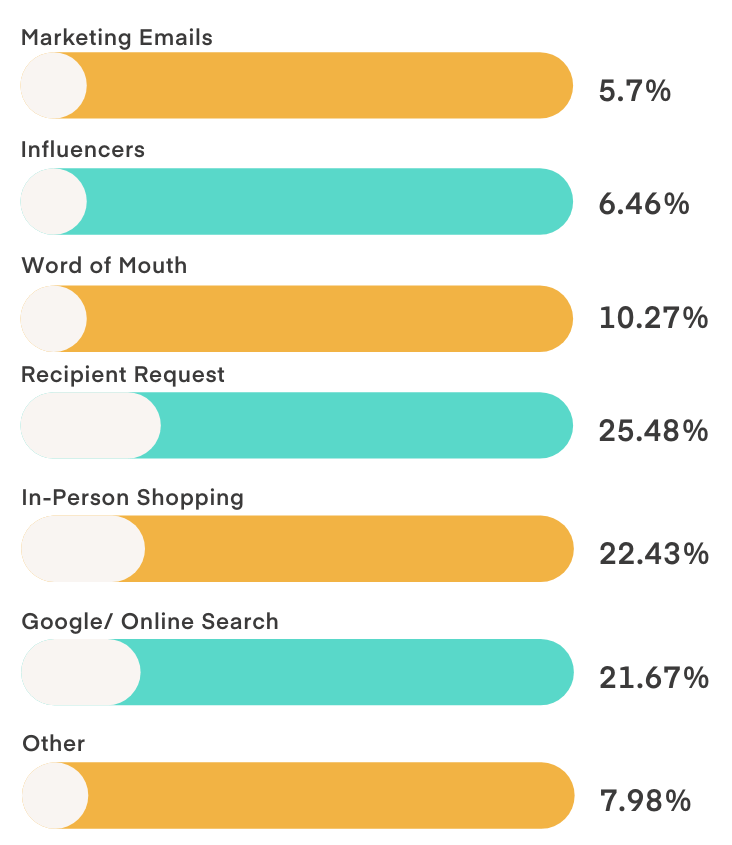

Where do you typically get your gift ideas?

This question is meant to help brands with TOFU optimization, more specifically, where to focus acquisition dollars to drive awareness.

This year’s respondents actually threw us for a loop, with the front runner being recipient requests (25.48%), followed by in-person shopping (22.45%), and Google/Online Search in third at 21.62%.

In 2022, Google/online search was the winner, and while these percentages are not dramatically different, it’s clear that consumers are continuing a post-pandemic transformation in how they shop, and acquisition strategies should evolve alongside them.

What surprised us the most was the low-end impact that word of mouth (10.27%) and influencers (6.46%) had—both of which make up a huge part of many brands’ marketing strategies. Yet, consumers aren’t pointing to them as their guiding light for inspiration.

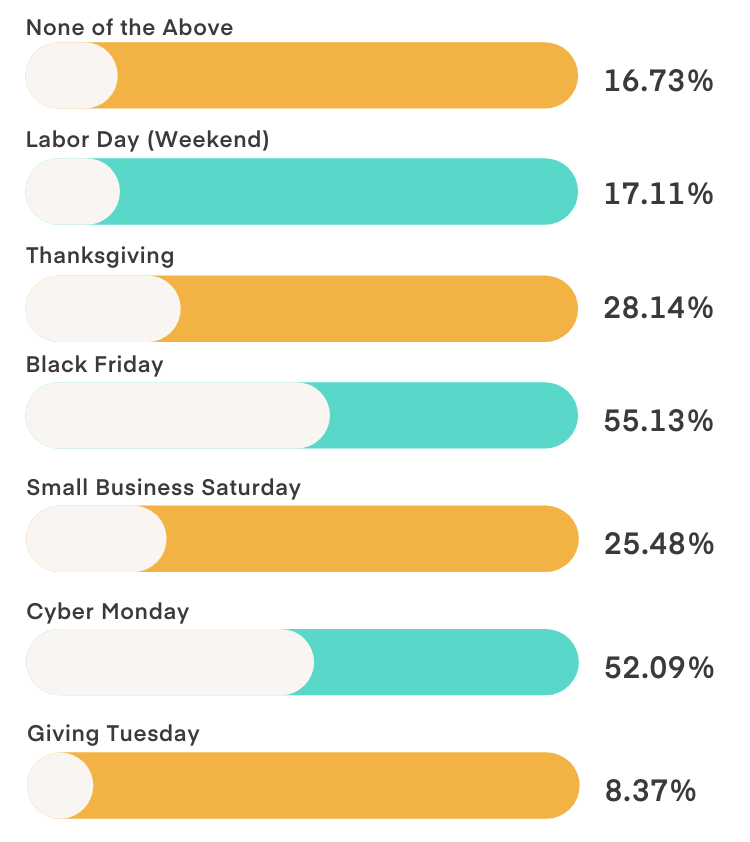

Thinking ahead to the holiday shopping season, are you planning to shop during any of the following days?

Black Friday is the biggest day for US shoppers yet again coming in at 55.13%, and Cyber Monday isn’t too far behind at 52.09%. The most surprising, though, is the 16.73% who are not planning on shopping at all during Cyber Weekend. These shoppers may be already done by the time the end of November rolls around, or they may think that BFCM sales just aren’t all that anymore. Make sure to find alternative ways to appeal to this segment for a strong Q4 through alternative campaigns or unique incentives.

Thanksgiving continues to grow in popularity, with 28.14% of consumers planning to shop in between their turkey and pie courses. Run a themed campaign on this day with special gifts or fun imagery—right out of the gate; you’ll stand out from the crowd and get in some early sales. This is also a good way to do your “early access” sale—let your subscribers get Black Friday deals one day earlier than everyone else for some exclusivity and FOMO.

25.48% of shoppers are looking for deals on Small Business Saturday—make sure to drum up interest for this day by playing up the back story behind your brand, connecting with consumers, or using social proof/reviews. This is a great opportunity to shine in a way that big box stores can’t compete with and leverage your unique brand experience.

Finally, the last day of Cyber Week is Giving Tuesday, and it’s still the smallest spending day of the weekend at 8.37%. For consumers to whom corporate responsibility is important—Giving Tuesday is a great way to connect and showcase all the ways your brand aligns with their values. Despite many consumers saying social causes aren’t a huge guiding factor in their brand choices, there is a small but devoted segment for whom it is—this is their day, and for the brands with a mission-driven purpose, they are your target audience.

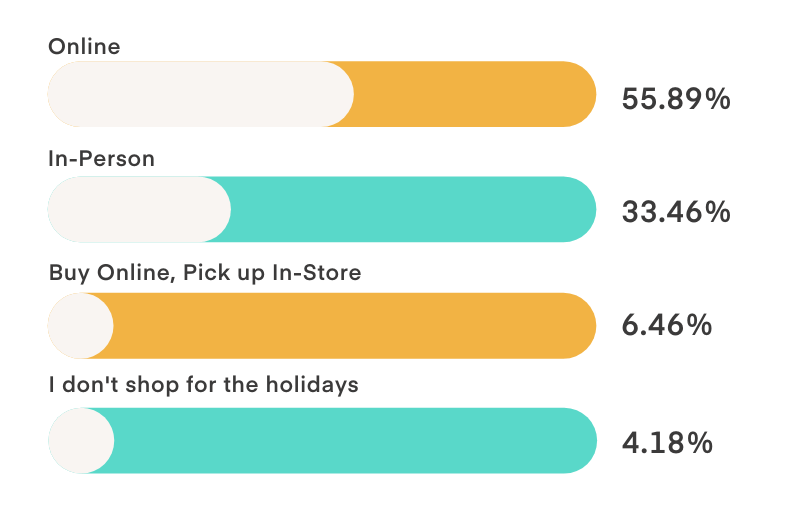

Where do you plan to do most of your holiday shopping?

Unsurprisingly online was the winner at 55.892%, but it’s worth noting that’s a five percent dip from last year. And those people are shopping in person now, with 33.46% of consumers choosing in-store as their preferred method.

This growth (return?) of in-person shopping’s popularity makes it clear that brands with storefronts or in-person placements are in a prime position to win market share this year.

BOPIS (buy online, pick up in-store) was a buzzword of the last few holiday seasons, which made its low performance here surprising, with just 6.46% of consumers planning to use it.

Though if you think about it in terms of how people usually have a bias towards painting themselves in a more favorable light…which in this case is not procrastinating their shopping list…BOPIS becomes an option of necessity rather than intention. So make sure to promote its availability as an option later on in the season, especially for those late December crunch days for maximum impact.

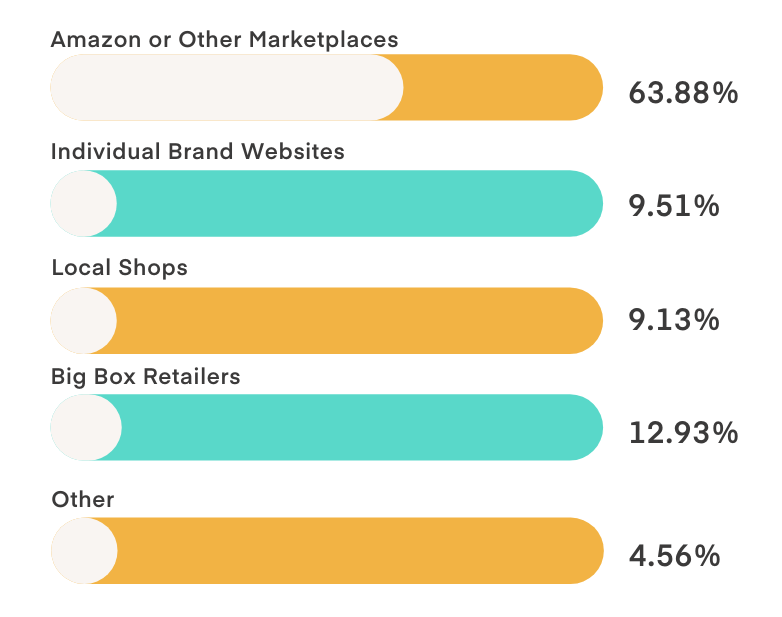

For online shopping, which of the following types of retailers do you plan on purchasing from?

Unsurprisingly, Amazon/marketplaces won by a landslide, with 63.88% of consumers planning to shop on them. This is something that many e-commerce brands have a tough time with—not being in these marketplaces is damaging when it comes to being where shoppers are, but they reap none of the rewards when it comes to first and zero party data, not to mention the cost of doing business.

So how can they compete and bring that measly 9.5% of consumers going to brand websites up? By providing an Amazonian-like experience. Clear, seamless checkouts (one-click = best); payment options like BNPL or Shop Pay; personalized product recommendations; and ultimately, by playing up the one thing that Amazon can’t compete on—the why behind the brand. Give them that and provide a great CX? You’ll have a customer for life.

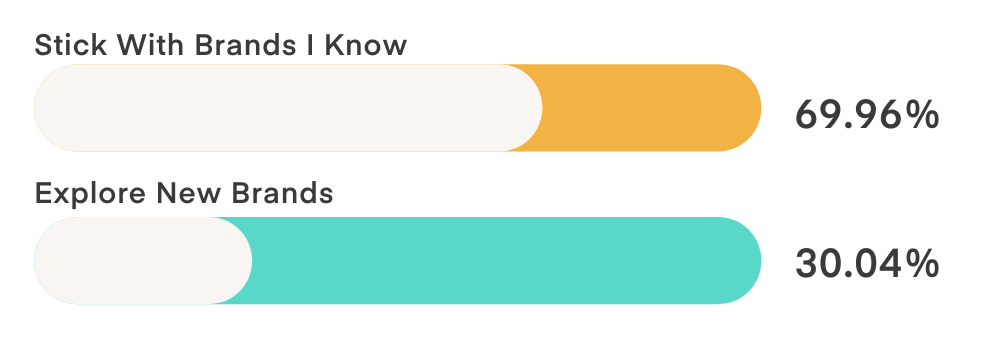

When holiday shopping, do you tend to shop from brands you know or explore new brands & websites?

This was another surprising difference from 2022 to 2023 was 10% more consumers saying they’ll stick with brands they know (69.9%) versus 30.04% who said they explore new brands. This is why retention and customer experience is so important. Not only are previous customers much more cost-effective to retain, but they’re becoming more valuable than ever over the course of their lifetime.

But we’re not here to fearmonger; there are still a third of consumers out there looking to be inspired and discover new brands. The key is following up post-holiday in the new year to bring them back into the fold so they don’t become a one-and-done sale.

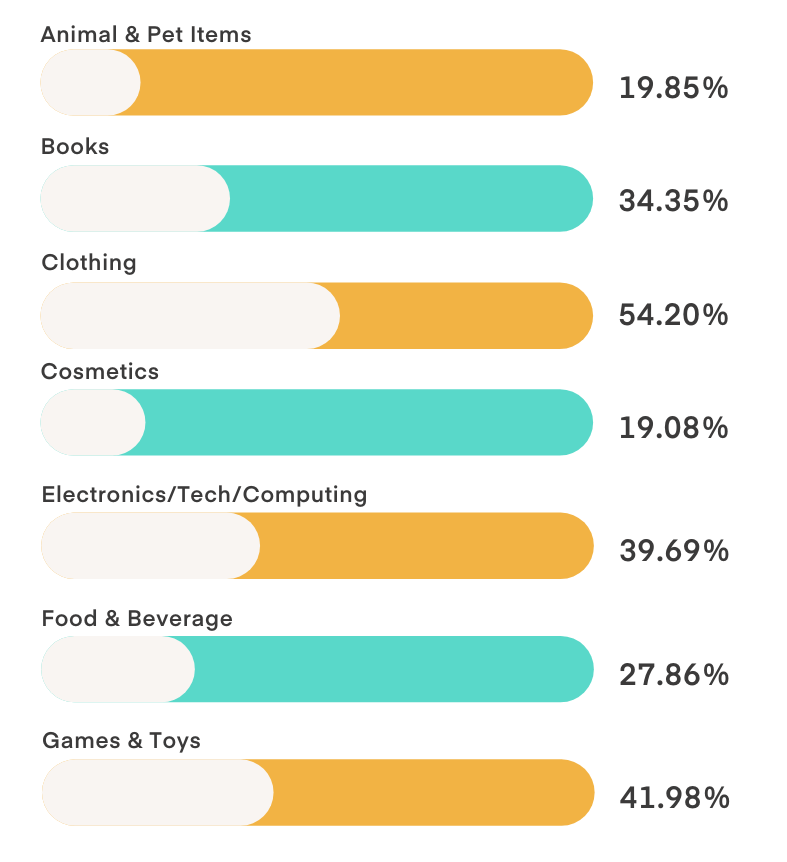

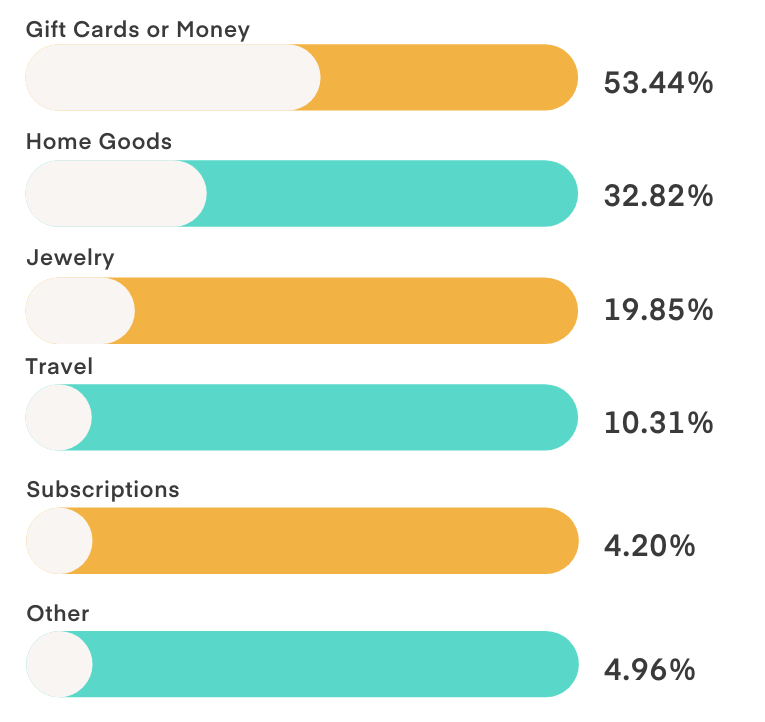

What are the top categories you expect to be gifting this year?

This is one of the questions where there weren’t many surprises in the data; the top industries were clothing/apparel, electronics/tech, games/toys, and gift cards/money.

If you’re not currently offering a gift card option on your website, you’re leaving money on the table. Position this as a safe choice for picky recipients or as a solution for indecisive (late) shoppers. You’ll close more sales, expand your audience, and provide consumers with the flexibility they’re looking for.

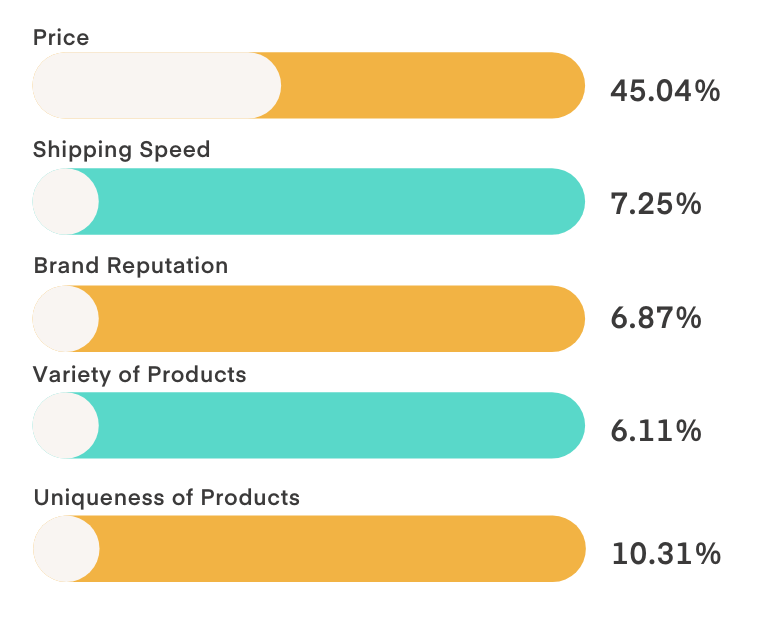

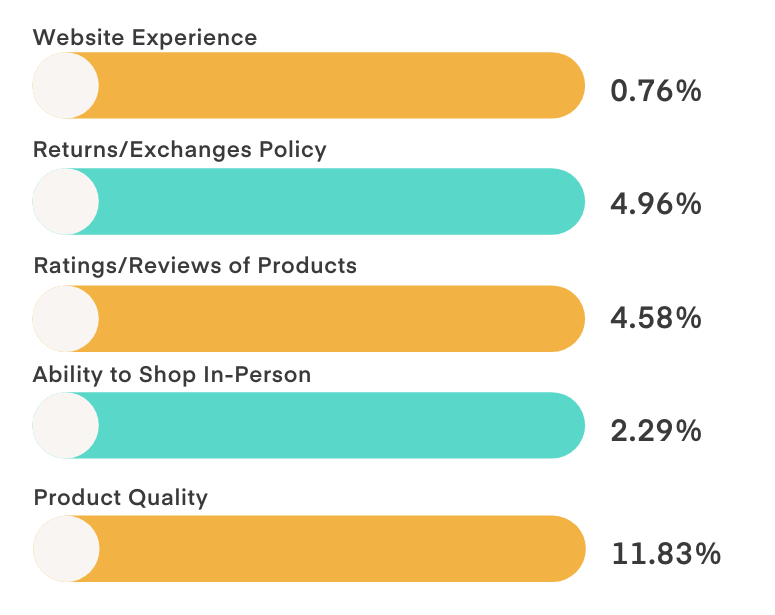

Which of the following is most important to you while shopping during the holiday season?

No surprise here that price took the gold medal two years in a row with 45.04% of the vote—the rest are kind of a mixed bag with a few surprising contradictions to previous answers.

Shipping speed was 7.35% here, but yet over a third of consumers were willing to pay extra for it in the question right below. Ratings were only 4.58%, but reportedly 95% of consumers read them before making an online purchase. The ability to shop in-person is 2.29%, and yet 33.46% said that’s where they will do the majority of their holiday shopping, just a few questions earlier.

With inconsistencies such as these in survey data, the cognitive dissonance in consumers becomes clear. They say they value one thing, but then when it comes down to it, they behave in a manner that proves overwise. There’s one thing we can all agree on, though—the most significant motivator for buyers is price. Everything else is just people being people.

We did think it was interesting that quality (11.38%) and uniqueness (10.31) were so close to a tie coming in second and third, respectively. This points to a consumer who is putting a lot of effort and thought into what they’re purchasing. This segment is one that brands can appeal to through warranties, satisfaction guarantees, and storytelling.

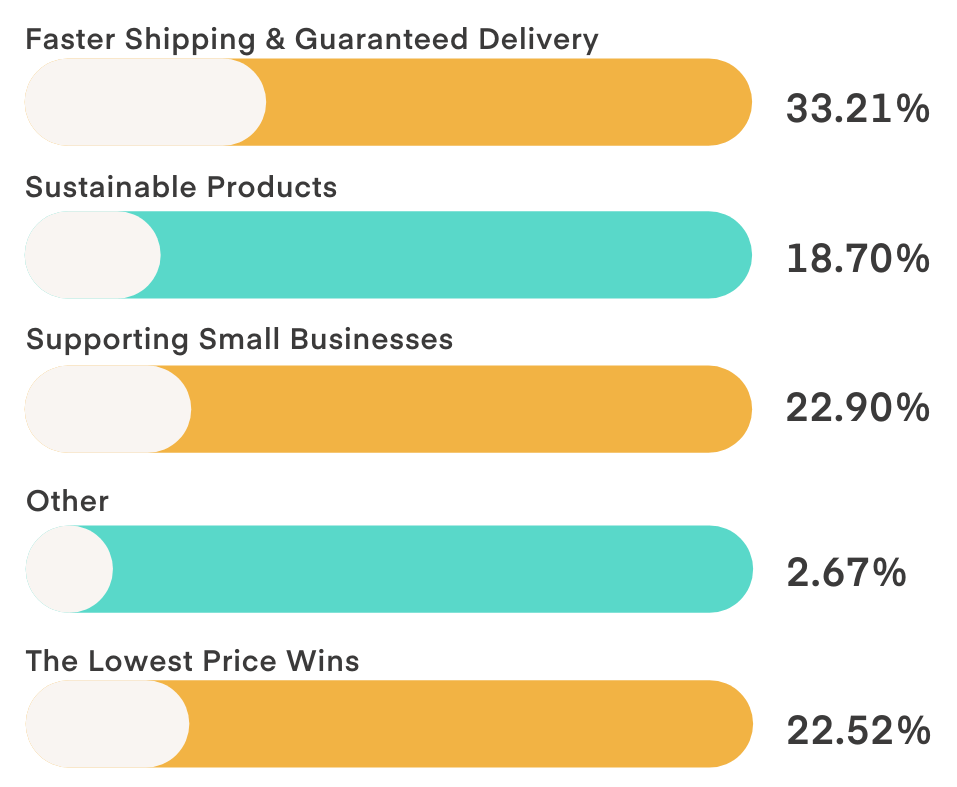

Which of the following would you pay more for?

This question looked at consumers’ bottom-line motivators and what they will truly pick when their money’s on the line. And dang, are the results interesting.

33.21% picked faster shipping/guaranteed delivery, 22.9% to support small businesses, 18.7% for sustainable products, and 2.6% for other. The kicker? 22.5% said they wouldn’t pay more for anything; the lowest price always wins.

The shipping/delivery option is interesting since it directly contradicts the “free-shipping” expectation we typically hear about. However, through the context of the holidays, it makes more sense…they’re willing to pay more when it’s for someone else, and there’s a hard deadline for arrival.

22.5% of people say the lowest price always wins, and with the results from the question above about price being most important to them—we honestly expected this to be higher!

The sustainable products result is interesting as we continue to hear about consumers voting with their wallets and wanting to see brands take a stance on this. But less than a fifth of consumers are willing to pay more for it (this is down from 2022 as well)…meaning sustainability is great when it’s at the same price point as other options, but for many consumers, it’s not worth the extra expense. We’ll have more on this in the question below.

Finally, supporting small businesses was a trend we saw emerge during COVID-times, with consumers thoughtfully trying to support their local communities and keep businesses afloat. But, like sustainability, it ends up a nice-to-have instead, with only about a fourth of consumers willing to pay extra.

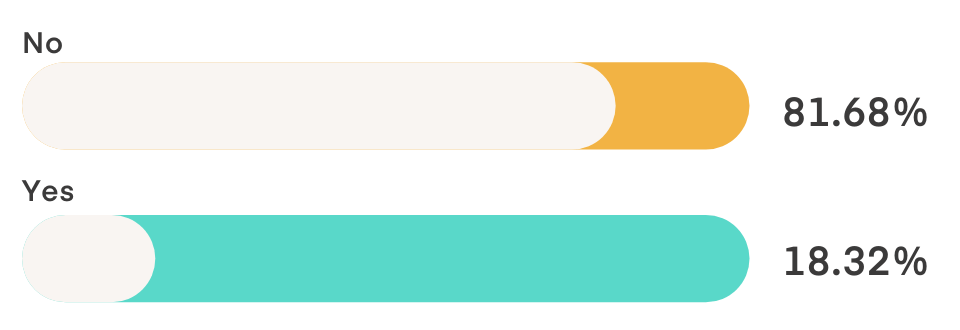

Do you take into consideration a brand’s support for social causes when shopping?

18.3% of US consumers say yes, and 81.6% of US consumers say no, which leads to an interesting split in how brands are being evaluated. There is also a generational component to take into consideration—younger consumers, for whom this is a reportedly strong factor, were only 22% of the respondents surveyed.

Want to see more audience demographic breakdowns? Check out our post on these survey results based on their age range to learn more about how to address the differences between Gen Z, Millennials, & Boomers.

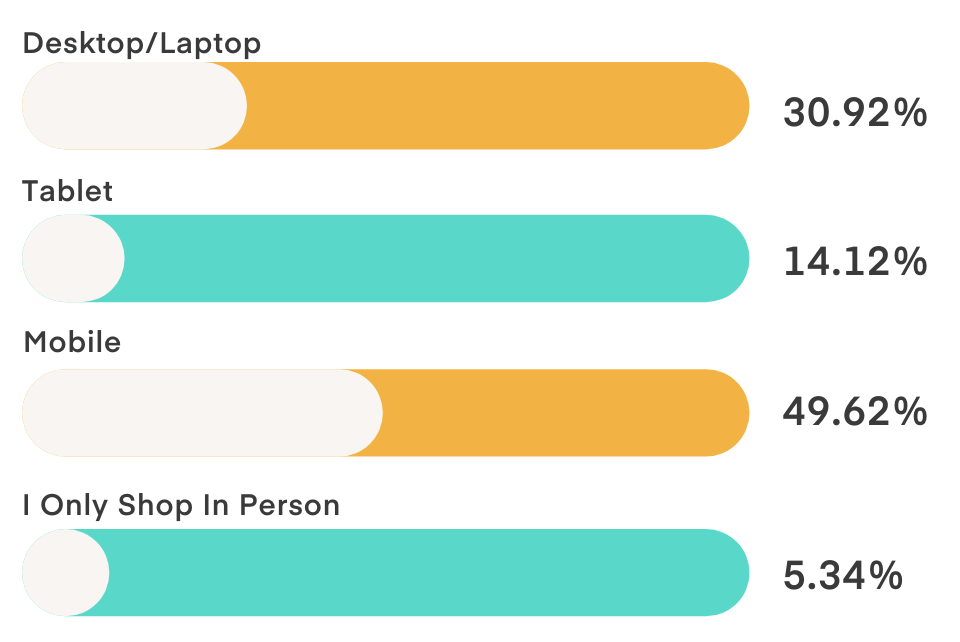

What type of device will you be doing the most holiday shopping on?

Mobile takes the lead with 49.62%, while only 30.92% are on desktop and 14.12% on tablets. This domination emphasizes how important a good mobile UX is, so run through your site to find any roadblocks to conversion these visitors may experience, including checkout, onsite messaging, and product pages.

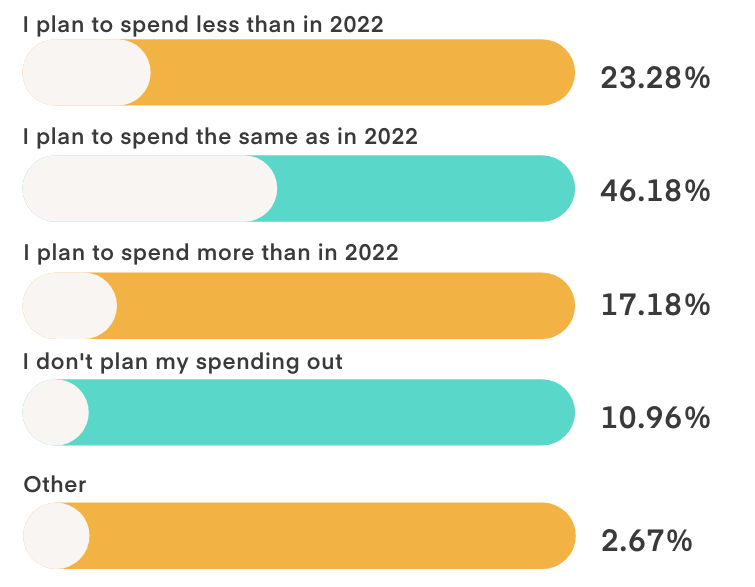

How will your holiday spending compare to last year?

This was an interesting one considering the economic climate we’re in right now (and have been for the last year+). As you see in the graph, 46.18% of US consumers are planning to spend the same as last year. Meaning despite continued recession talk, skyrocketing interest rates, inflation, etc…people are ready to celebrate the holidays in style, even if higher prices mean they’re gifting less while spending the same amount this year.

Nearly 28% of Americans are defying economic doom and gloom, though, with 17.18% planning to spend more than last year and 10.69% who don’t budget or plan their spending at all.

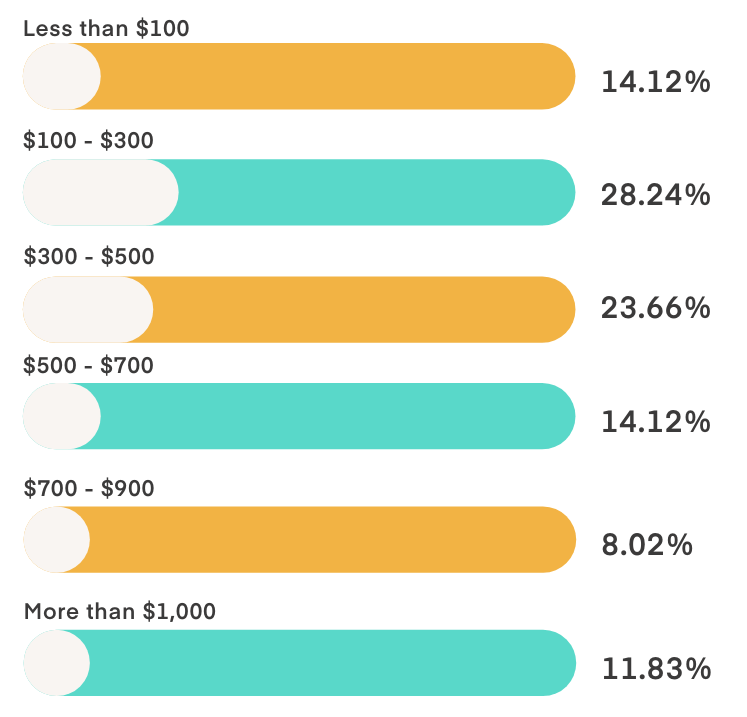

What is your holiday gifting budget this year?

With the current economic climate and sustained inflation in the US, this question is meant to get at the true buying power that consumers are heading into Q4 with.

The $100-300/$300-500 bracket dominated, with nearly 52% of consumers falling into this range. Compared with the NRF’s 2022 holiday gifting budget of $832.84, this is a little lower, meaning that while consumers are bullish heading into the 2023 season, their budgets aren’t quite as steady as they reported when comparing this year to last.

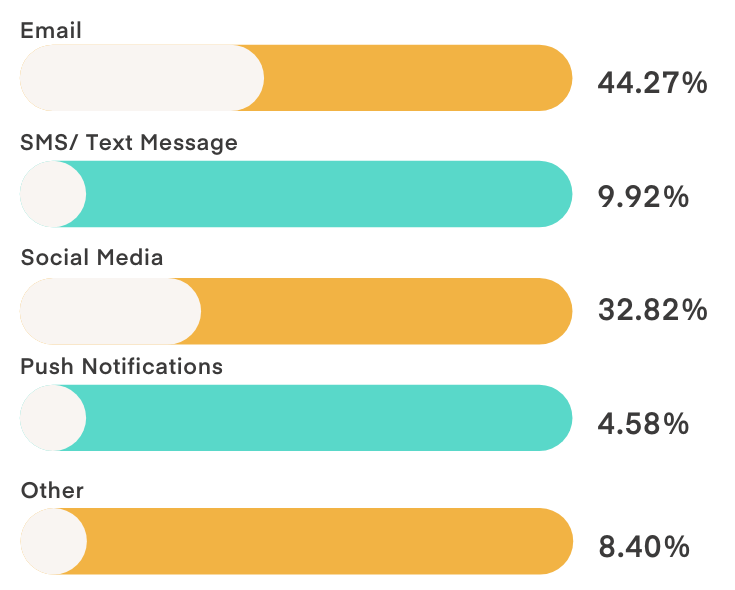

What channel do you prefer to hear from brands on?

This provided an interesting snapshot into the minds of consumers—we’ve all heard many people proclaim that email is dead (FYI, we’re not one of them), and we’re happy to report they couldn’t be more wrong.

44.27% of US consumers would prefer to hear from brands via email versus only 9.92% via SMS, 32.82% on social media, and 4.58% from push notifications.

And these numbers are almost exactly the same as they were in 2022, meaning consumers haven’t abandoned one channel in favor of another. In fact, any changes were all less than 1% from the previous respondents except for push notifications. Those nearly doubled in popularity from 2.36% in 2022

But beyond that, it’s another low year for SMS Marketing despite its growing popularity amongst brands as their primary list-building focus. We think this goes to support the view that consumers see SMS as a more sacred channel. Reserved only for brands they deem special enough, and when it comes down to it…they would rather shift through an email inbox.

Overall, we’d say that shoppers in the US are going to shop in stores more, browsing on their phones, looking at their email for the best deals, returning to brands they know, and while they’re starting early, there is still a strong habit to hold on until BFCM to make sure they’re getting the best deals of the season.

Final Thoughts

While this survey is only a snapshot of the US consumer bases—it offers insight into how brands can position themselves for a strong Q4. These results can help power campaigns that resonate more with shoppers and give them what they really want rather than what we, as marketers, assume they do.

Some key takeaways to apply to your marketing plans are:

- Create mobile-friendly experiences. Consumers continue to shop heavily on their phones. Streamline their experiences, and plan for the small screen.

- Don’t assume their channel preferences. Never make SMS your only channel to opt in to. Always provide the opportunity to choose email as well via a two-step lead capture, and we don’t recommend making both a requirement to earn an incentive. Don’t let short-term goals get in the way of long-term growth (or short-term money at that rate). And always send the coupon immediately to their channel of choice (and provide it onsite as well) to prevent frustration.

- Amazon is a necessary evil. Amazon and other large marketplaces are key channels for consumers which opens up the door to a huge number of new audiences. Obviously, purchasing directly from your website is the preferred method, but we can’t argue with the visibility and awareness it can bring to your brand.

- There is no “start” to the season anymore. Consumers have been fundamentally changed by the past few years, and therefore we can’t truly say there’s an official start to the shopping season now. Before, it could’ve been said that Amazon Prime Day was the unofficial one in October, but with it moving to July…it’s anyone’s game. Plan to start early, be present, and stay late with your messaging…it’s not your mother’s BFCM anymore.

2023 has been an interesting year, and while we will not be using the word unprecedented to describe economic landscapes or the e-commerce world anymore—there is yet another holiday season upon us that requires nimble execution, offers little resemblance to years past, and has many factors impacting its success.

Good luck this year! Find more BFCM content here throughout the season, including blogs, ebooks, webinars, and more, all in one place for your convenience.

If you’re looking to take your onsite experience to the next level and personalize it for every visitor—try our free 14-day trial to experience the Justuno difference, or let us do the heavy lifting with our managed services white-glove plan.